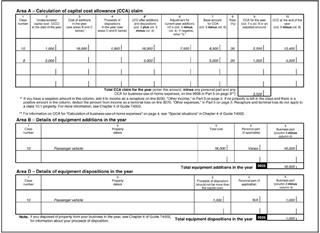

If you use your capital assets for your business, you can claim tax deduction on your capital asset. To calculate capital cost allowance tax deduction, and any recaptured CCA and terminal losses, you should use Area A on page 5 of your Form T2125.

Even if you are not claiming a deduction for CCA, you still should complete the appropriate areas of the form T2125 to show any additions and dispositions during the year.

Below, we explain how to calculate capital cost allowance.

Column 1 – Class number of your properties

If this is the first year you are claiming CCA, you can find the class number in Capital Cost Allowance Class of commonly used business asset. If you claimed CCA last year, you can get the class numbers of your properties from last year’s tax return form.

Column 2 – Undepreciated capital cost (UCC) at the start of the year

If this is the first year you are claiming CCA, skip this column. Otherwise, enter in this column the UCC for each class at the end of last year. Enter the amounts from column 10 of your last year T2215 form.

Column 3 – Cost of additions in the year

If you buy or make improvements to depreciable property in the year, CRA consider them to be additions to the class in which the property belongs. To calculate capital cost allowance for these asset additions, you should complete Area B and Area C of your Form T2125 as explained below.

-

Area B – Details of equipment additions in the year

List the details of all equipment (including motor vehicles) you purchased. Group the equipment into the applicable classes.

Column 4 – Proceeds of dispositions in the year

Enter the details of your dispositions as explained below.

If you disposed of a depreciable property, enter in column 3 of the appropriate dispositions area (Area D or Area E) one of the following amounts, whichever is less:

- your proceeds of disposition minus any related expenses; or

- the capital cost of the property.

Column 5 – UCC after additions and dispositions

You cannot claim CCA when the amount in column 5 is:

- negative (see “Recapture of CCA” below); or

- positive and you do not have any property left in that class at the end of the year.(see “Terminal loss” below).

Column 6 – Adjustment for current-year additions

In the year you acquire or make additions to a property, you can usually claim CCA on half of your net additions (the amount in column 3 minus the amount in column 4). CRA call it the half-year rule.

Column 7 – Base amount for CCA

Base your CCA claim on this amount. For a Class 10.1 vehicle you disposed, you may be able to claim 50% of the CCA that would be allowed if you still owned the vehicle at the end the year. This is known as the half-year rule on sale.

Column 8 – Rate (%)

In this column, enter the rate for each class of property in Area A.

Column 9 – CCA for the year

In column 9, enter the CCA you want to deduct for 2013. The CCA you can deduct cannot be more than the amount you get when you multiply the amount in column 7 by the rate in column.

Column 10 – UCC at the end of the year

This is the undepreciated capital cost (UCC) at the end of the year. This is the amount you will enter in column 2 when you calculate capital cost allowance claim next year.

Special rules to calculate capital cost allowance

-

Recapture of CCA

If the amount in column 5 is negative, you have a recapture of CCA. Include your recapture in your income on line 8230, “Other income” in Part 3 on page 2 of your Form T2125. A recapture of CCA can happen if the proceeds from the sale of depreciable property are more than the total of the UCC of the class at the start of the period plus the capital cost of any new additions during the period.

-

Terminal loss

If the amount in column 5 is positive and you no longer own any property in that class, you may have a terminal loss. More precisely, you may have a terminal loss when, at the end of a fiscal period, you have no more property in the class but still have an amount you have not deducted as CCA. You can usually subtract this terminal loss from your gross business or professional income in the year you disposed of the depreciable property. Enter your terminal loss on line 9270, “Other expenses,” in Part 5 on page 3 of your Form T2125.

Example on how to calculate capital cost allowance

When Cathy bought her new car in May 2014, it cost $16,000 including all charges and taxes. Since the cost of the car was $30,000 or less, she includes the car in Class 10. She was allowed a $1,000 credit when she traded in her old car (which was also in Class 10). Her UCC on the old car at the start of 2013 was $1,000. Cathy knows that her personal use of the car will vary each year.

Cathy has a desk, calculator, filing cabinets, and shelves in her store. These are Class 8 depreciable properties. The UCC of these properties at the start of 2013 is $5,000. She did not buy any Class 8 properties in 2013.

Therefore, she completes Form T2125 as follows:

Since Cathy used the car partly for personal use, she calculates the amount to include on line 9936 for her car as follows:

25,000 (business kilometres)/ 30,000 (total kilometres)× $2,550 = $2,125

She wants to claim the maximum CCA allowed to her in 2014. The most that Cathy can claim for CCA for 2013 is $2,125 for her car and $1,000 for the Class 8 properties.

She enters $3,125 on line 9936 in Part 5 on page 3 of Form T2125.