In the previous post Understand tax deduction, we learn how tax deductions save your tax. In this post, we will show you how tax credit reduces your tax by example.

Tax credit directly reduces tax liability and hence produces the same tax saving amount for all taxpayers, despite their income and marginal tax rates.

There are two types of tax credits: refundable tax credit and non-refundable tax credit.

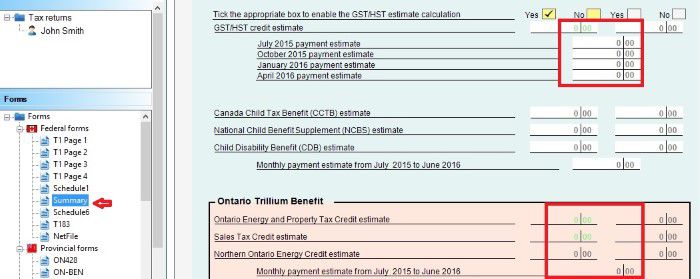

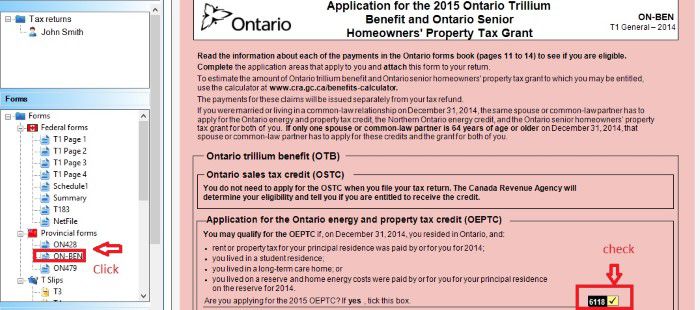

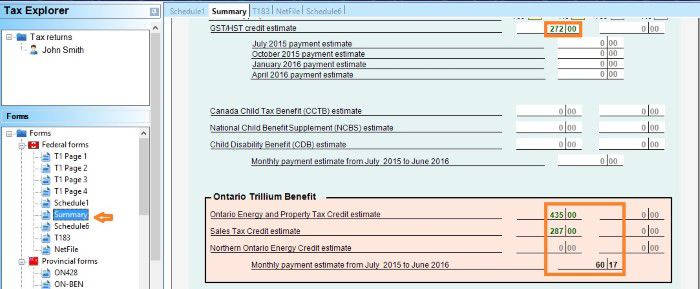

- Refundable tax credits will pay you a tax refund. The most common credits are: Working Income Tax Benefit (WITB), GST/HST credit and Ontario Trillium Benefit (OTB).

- Non-refundable tax credit reduce your tax payable. It can’t be used to get you a refund if you don’t need to pay tax. Howervr, you may be able transfer those unused amounts to your family members or carry them forward to future tax years. The most common tax credits are Child amount, Tuition amount, Disability amount and public transit amount.

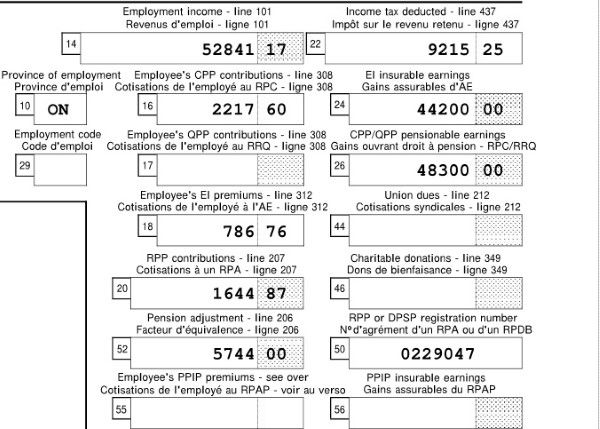

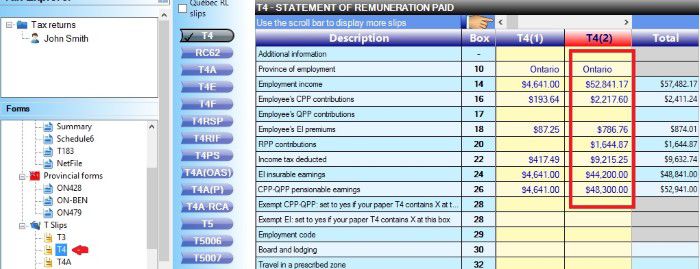

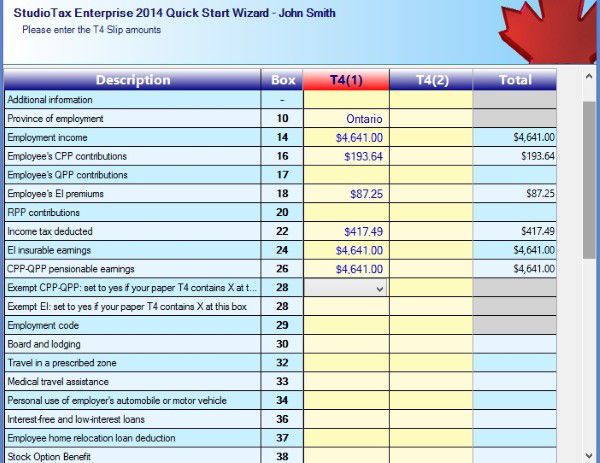

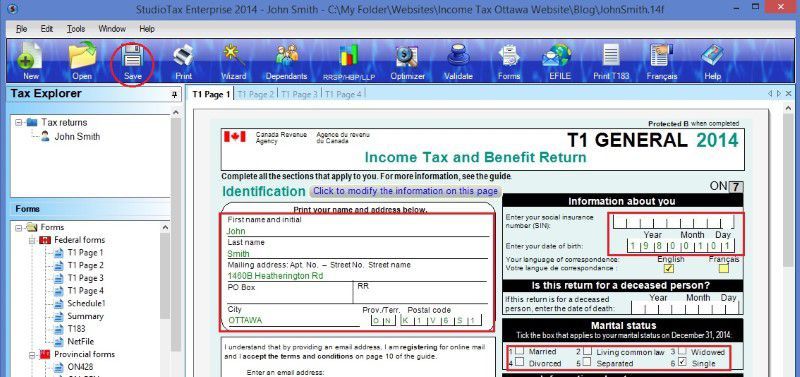

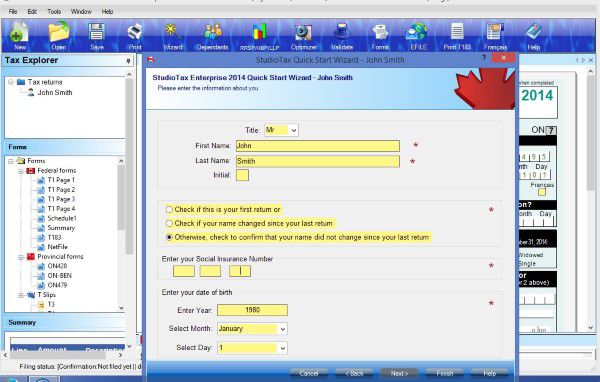

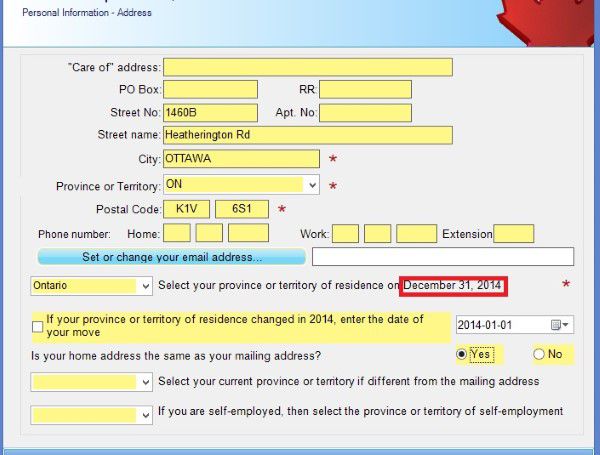

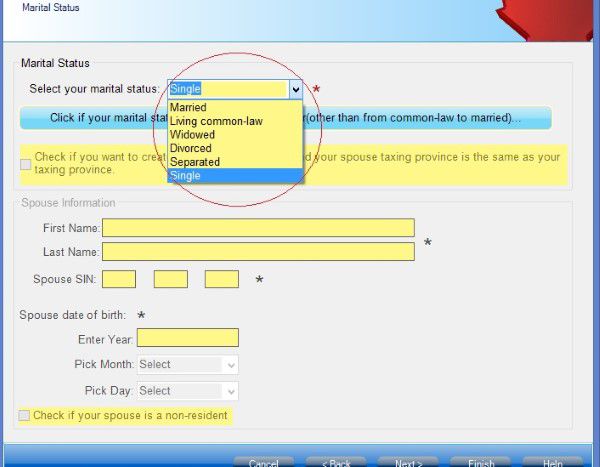

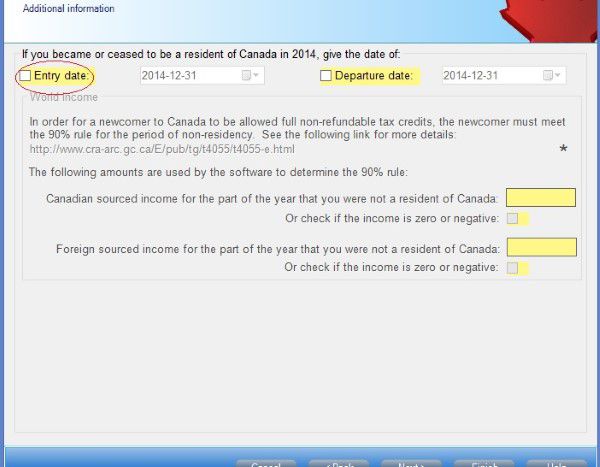

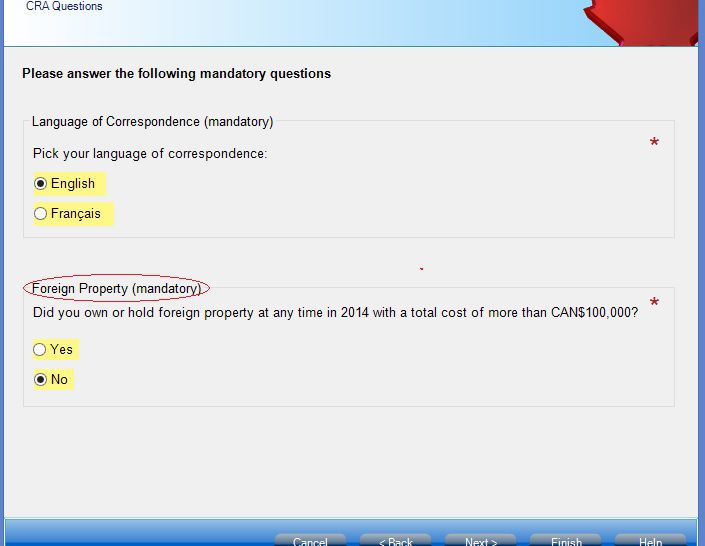

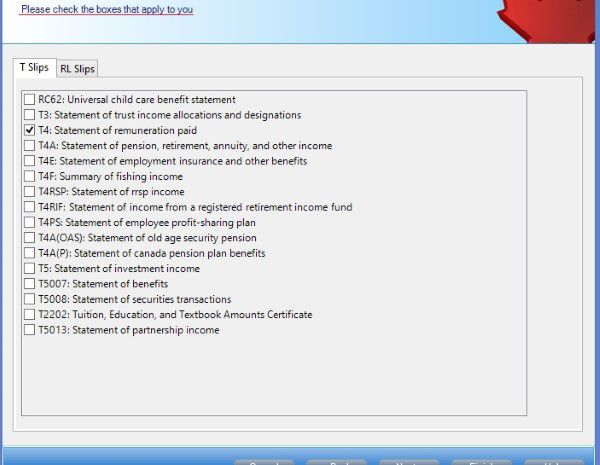

Client information is the same as part 4.

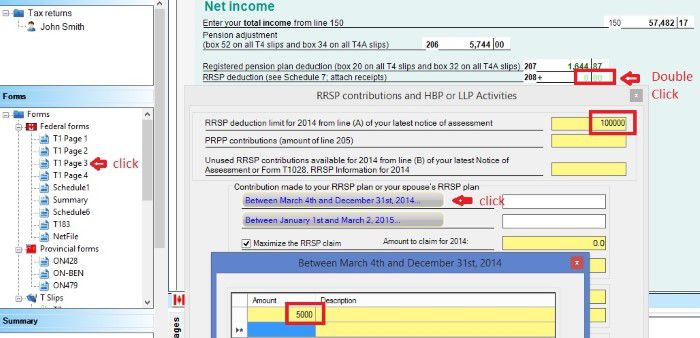

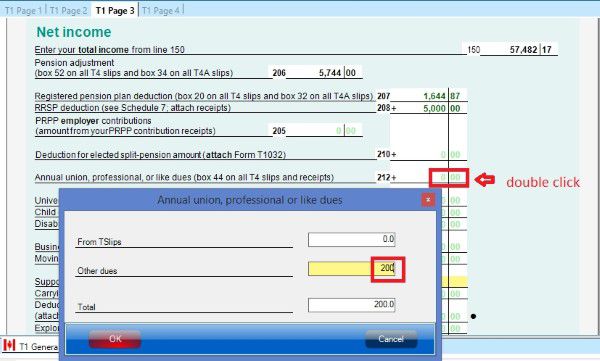

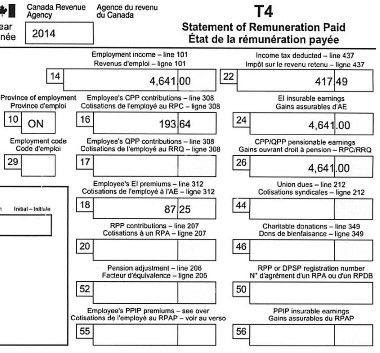

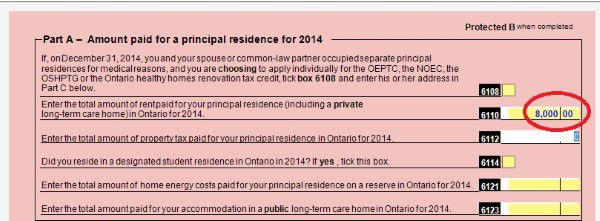

John Smith, single, living in Ottawa, has 2 T4 tax slip and pay rental payment $8000 in 2014. He made $5000 Registered Retirement Saving Plan (RRSP) contribution, and paid $200 union due, which is not included in his T4.

Additional information in this case study

- He paid $1000 for his monthly bus passes in 2014.

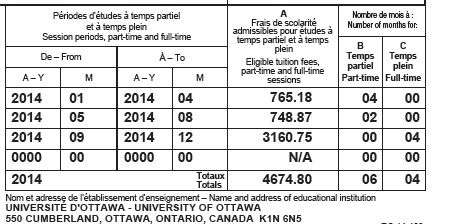

- He studied in Ottawa University and paid tuition fees. He got a T2202A tax slip from his school as below.

Continue with part 4, let’s prepare his tax return step by step.

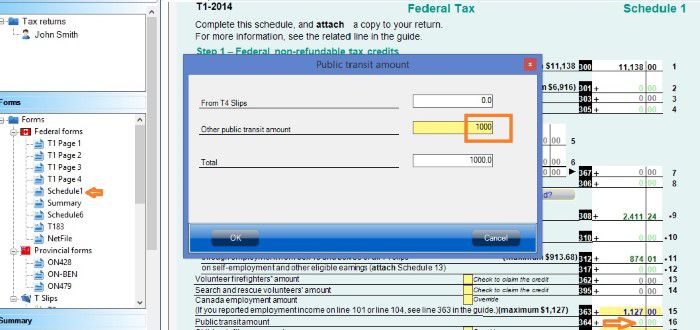

1. Input the $1000 monthly bus passes amount.

- Click Schedule 1 on the left.

- Double click Public transmit amount line 364, a window should pop up.

- Input $1000 on the other public transit amount, and then click OK.

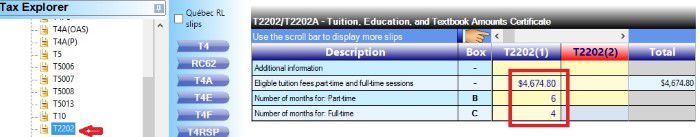

2. Input the T2202A tax slip.

- Scroll down, and click the T2202 on the left.

- Input tuition fees paid, number of months in part-time and number of months in full time study as above.

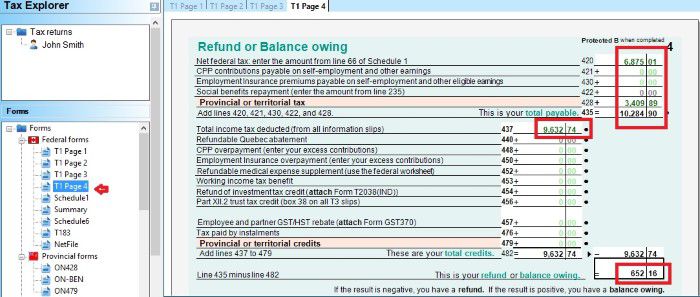

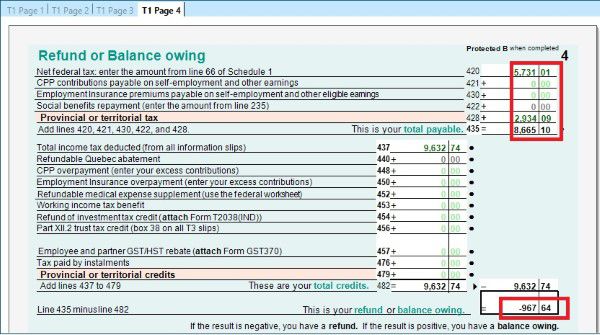

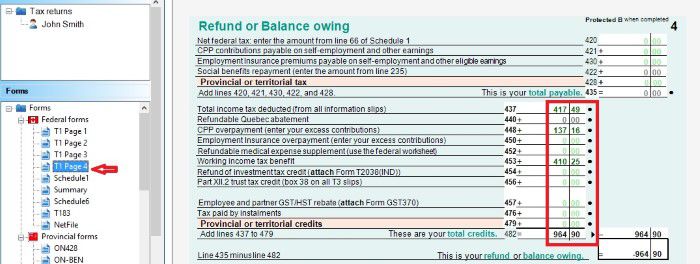

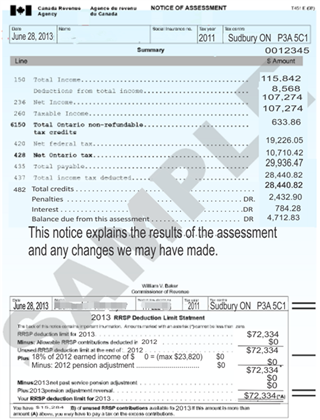

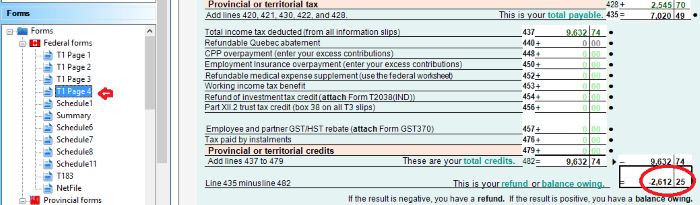

3. Check the tax refund.

Go back to T1 page 4, you will see the tax refund is $2612.25, increasing from $967.64. By adding the public transmit and tuition tax credit, the total tax saving is $1644.61 ($2612.25 – $967.64).

Easy, right? You already know how to do it. Want to know why? Continue reading.

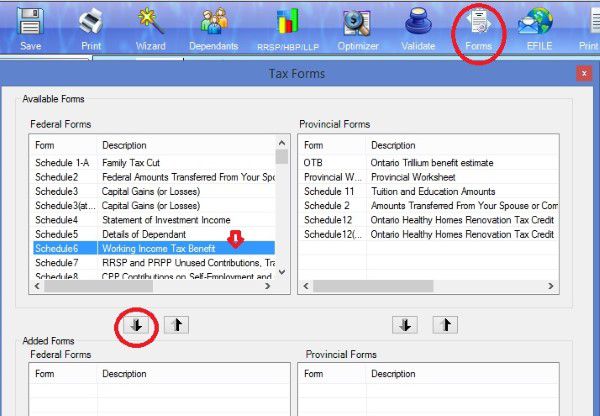

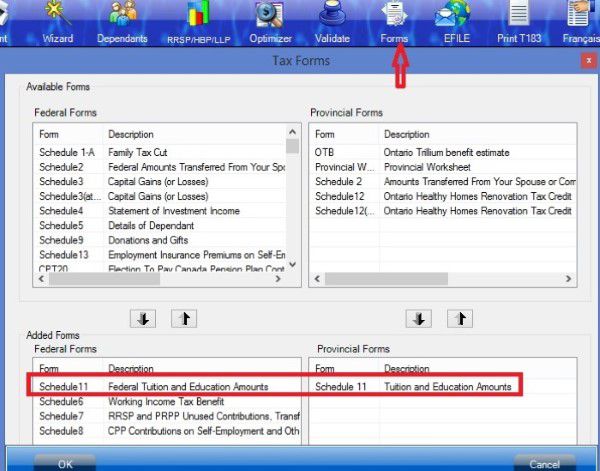

1. Get Federal Schedule 11 and Ontario schedule S11.

- Click the form on the menu.

- Add Federal schedule 11 on the left and Ontario schedule 11 on the right.

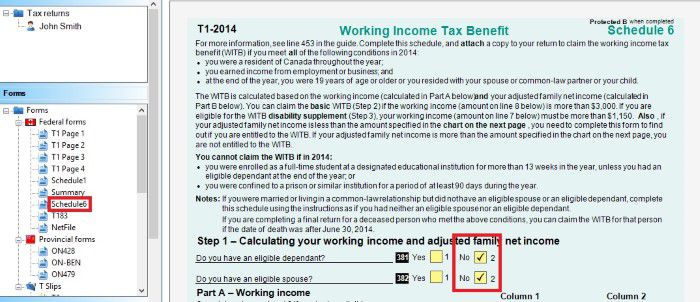

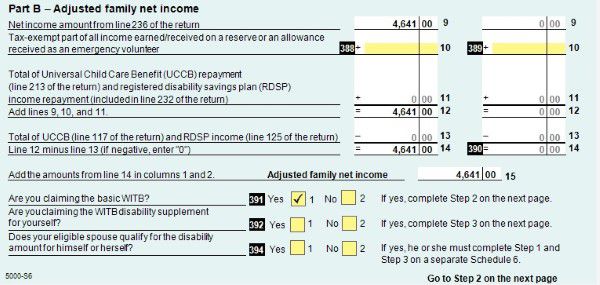

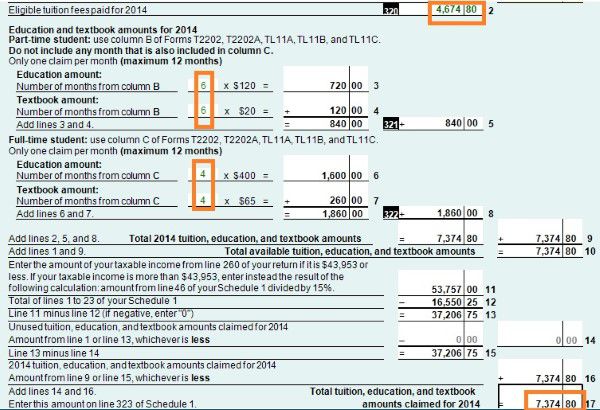

2. Open federal schedule 11

You will see how the tuition amount 7374 is calculated based on the tuition fee paid, number of months in full time and part time study.

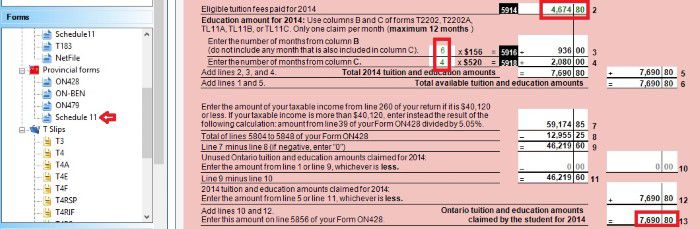

3. Open Ontario schedule 11

you will see how the tuition amount 7690.8 is calculated based on the tuition fee paid, number of months in full time and part time study.

4. Go back to federal schedule 1.

You will see the total tax amount for tuition and public transmit is 8374.8 (1000+7374.8). Federal non-refundable tax credit rate is 15%. So the tax credit for the 8374.8 is 1256.22 (8374.8×15%). In other word, by adding the public transmit and tuition amount, the federal tax saving amount is $1256.22.

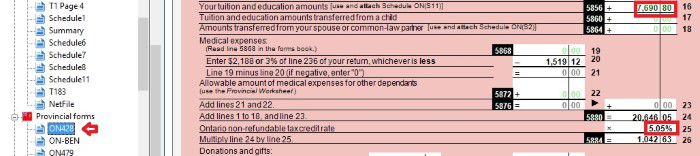

5. Click the ON428 to check Ontario tax credit.

Public transmit amount is not qualified as Ontario tax credit, so you won’t see it on ON427. Ontario non-refundable tax credit rate is 5.05%. So the tax credit for the 7690.8 is 388.39 (7690.8×5.05%). In other word, by adding tuition amount, the Ontario tax saving amount is $388.39.

The total tax saving is $1644.61($1256.22+$388.39) by claiming public transmit and tuition fee amounts.

Click to read all articles about Tax Courses.